Every DTC founder feels the same mix of chaos and adrenaline around BFCM.

But the truth? Most post-mortems stop at surface-level stats: “record GMV,” “highest traffic ever.”

At Aimerce, we see deeper.

Through 1,000+ Shopify + Klaviyo installs, our telemetry tells a more grounded story: tracking inefficiencies, pixel mismatches, and list bloat cost real dollars.

So before we rush into 2025 prep, let’s pause and unpack what actually moved revenue in 2024.

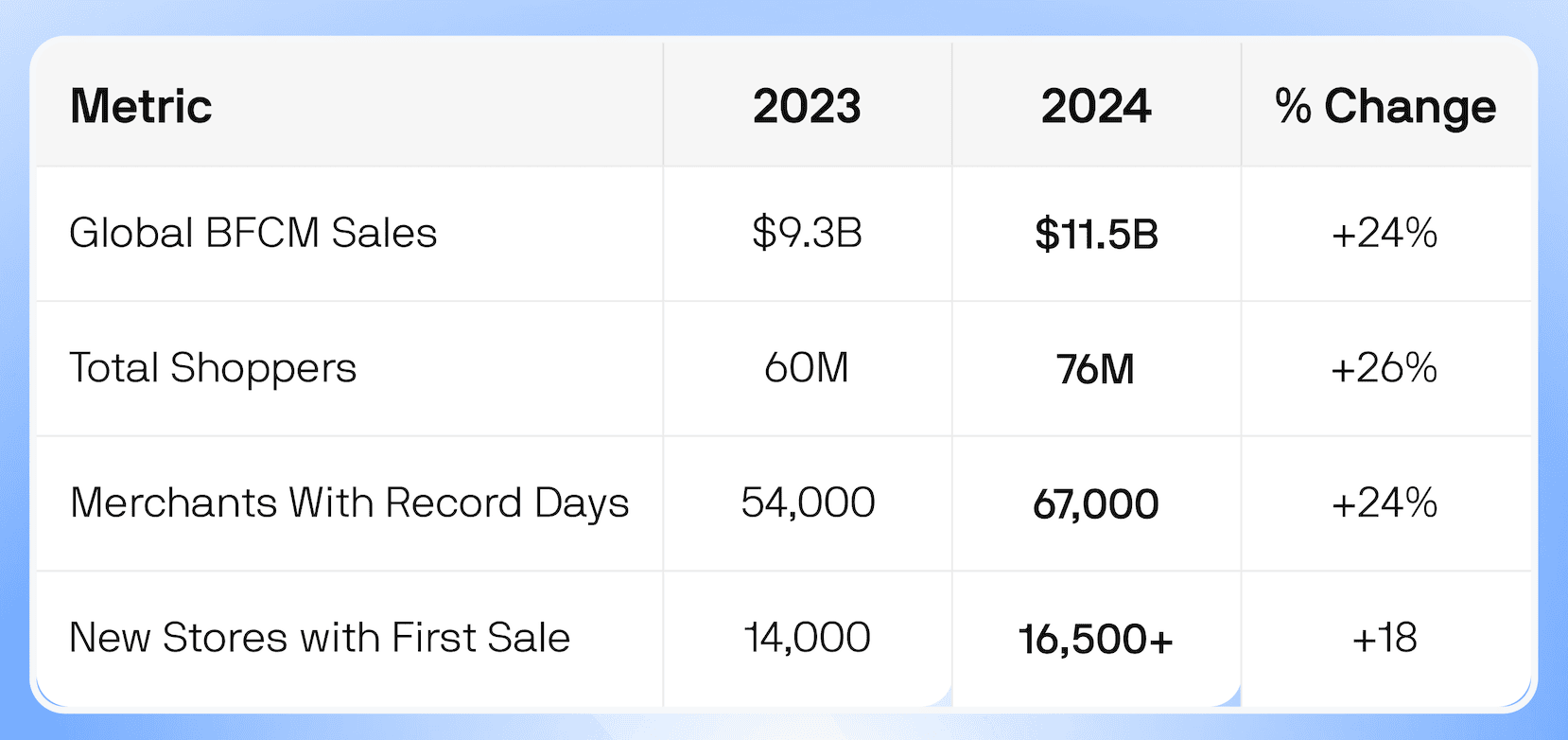

The Macro Picture (Shopify Data Highlights)

- $11.5B in total BFCM sales —> +24% YoY

- 76M shoppers purchased from Shopify brands

- 67,000 merchants hit record single-day sales

- 16,500+ new stores made their first-ever sale

That’s scale. But it hides the signal: who actually made money and why?

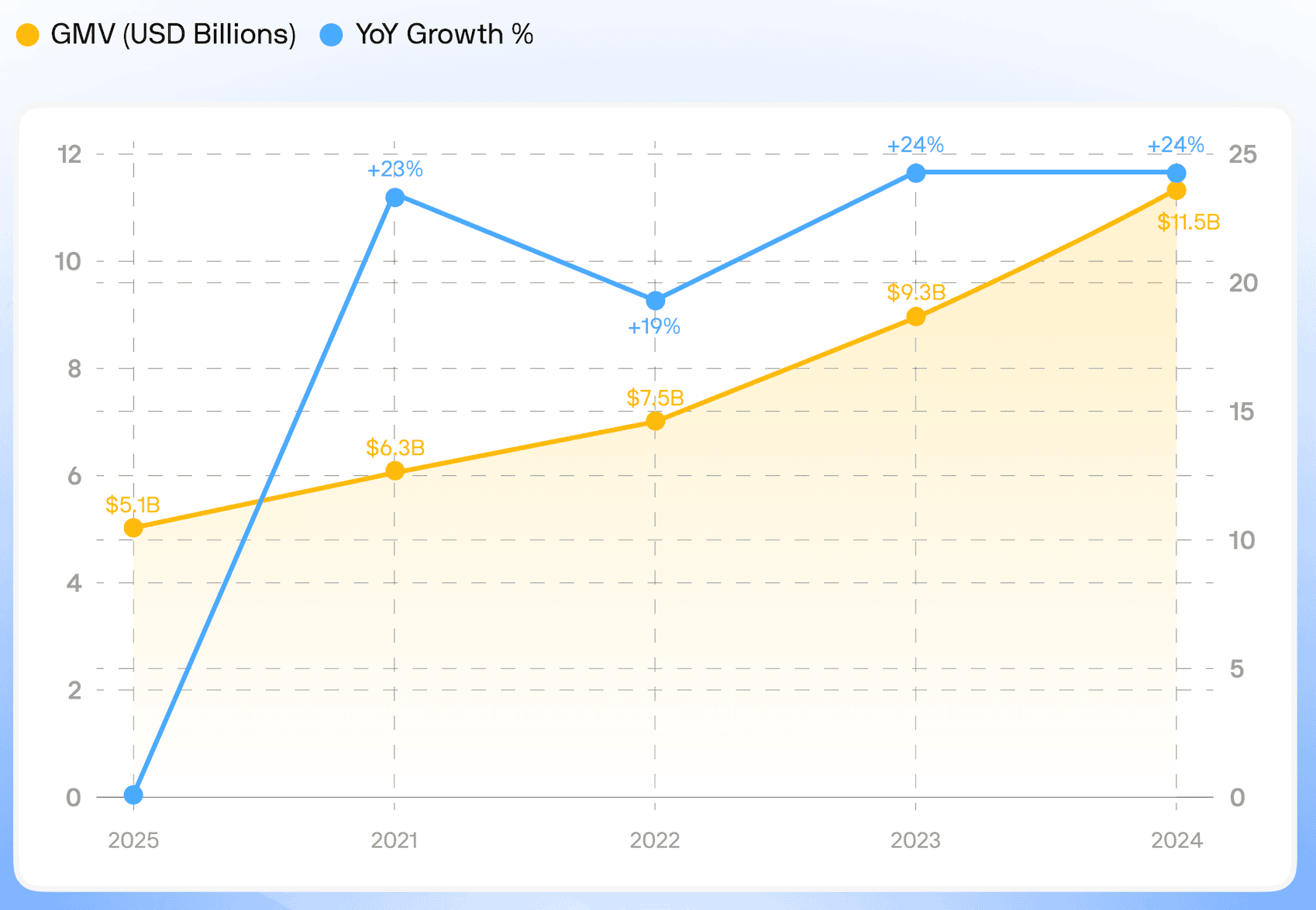

Global BFCM GMV Growth (2020-2024)

Insight: Shopify merchants hit $11.5B in BFCM sales, up 24% YoY.

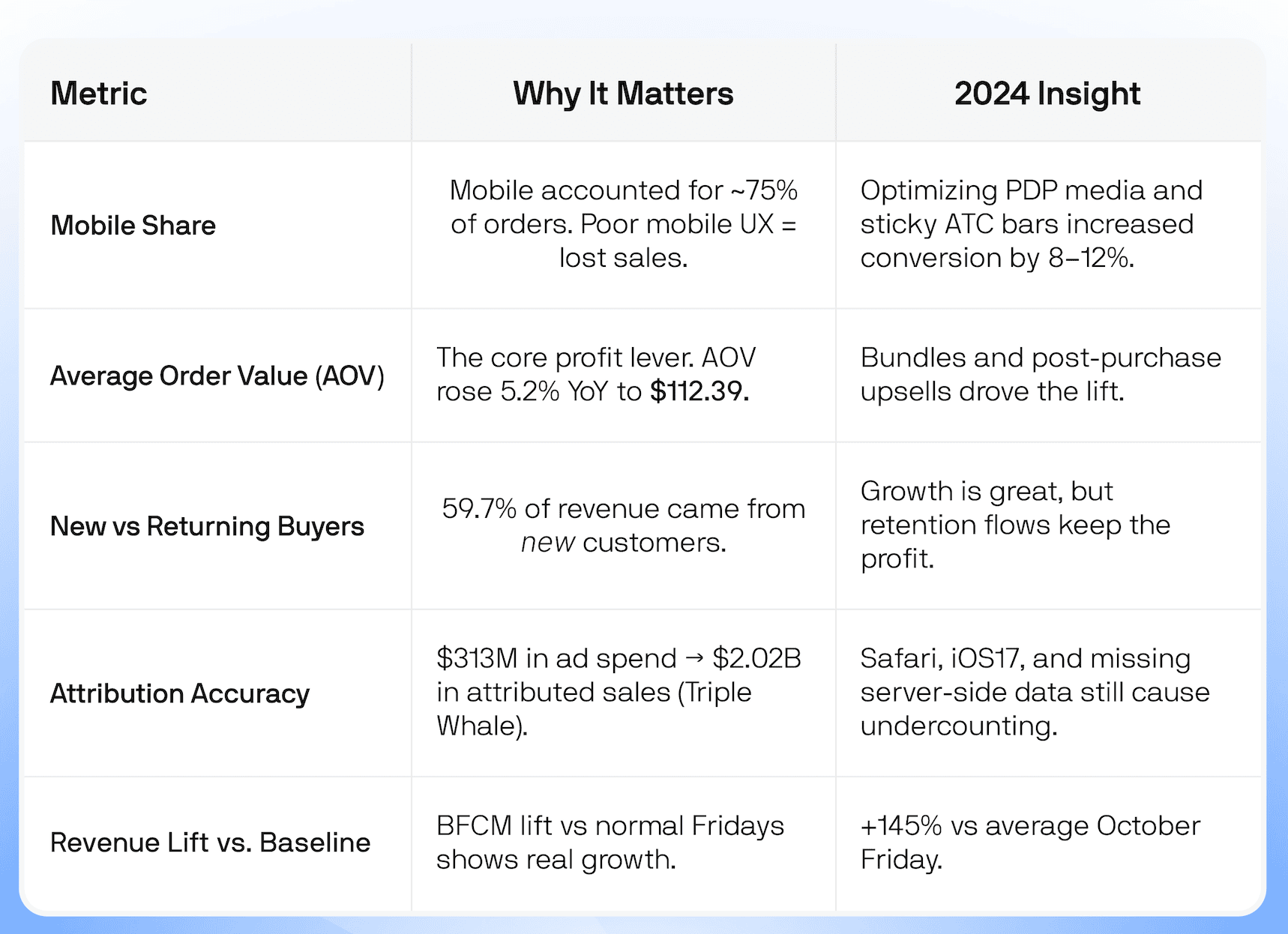

The Metrics That Actually Mattered

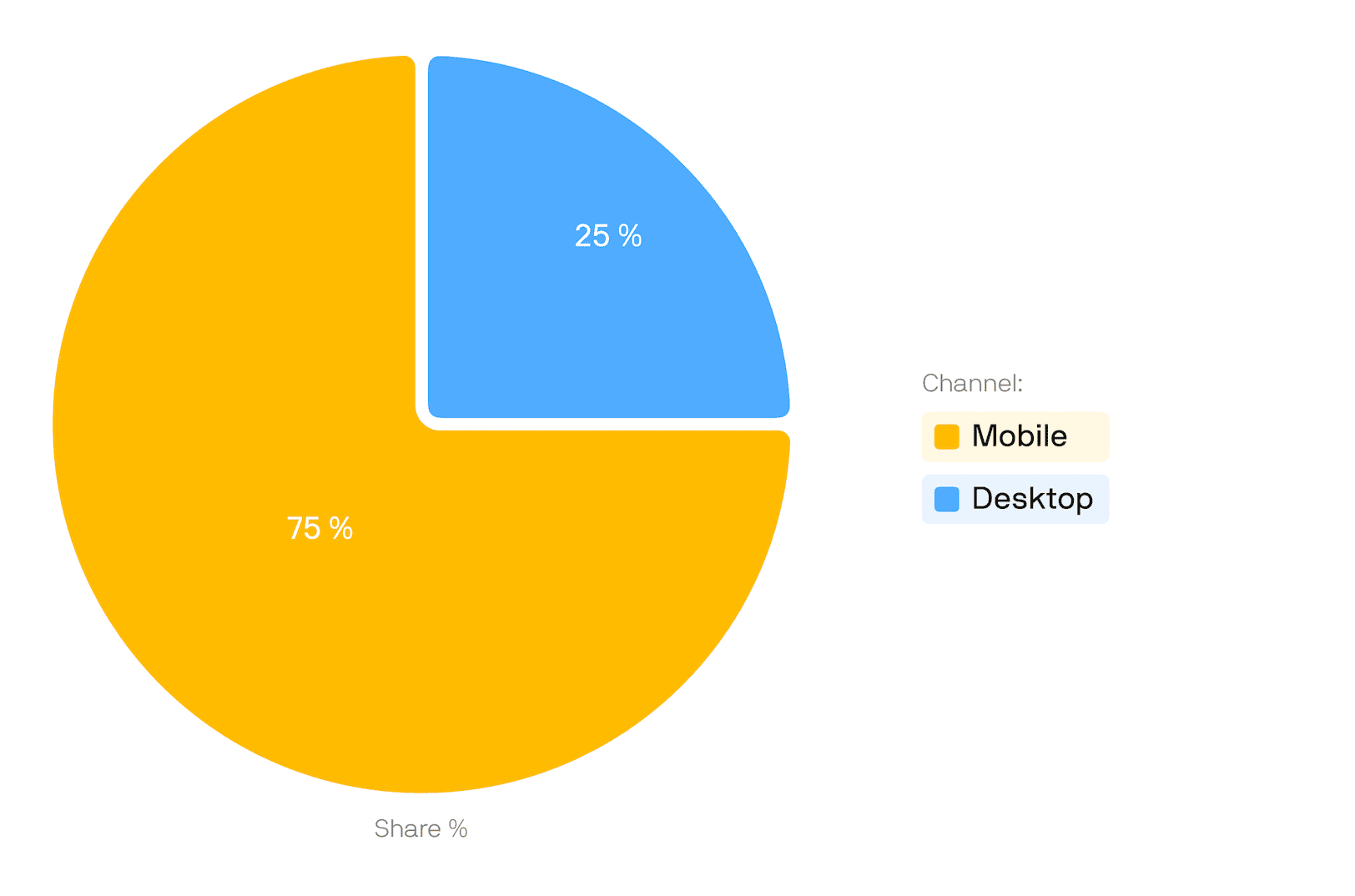

Mobile vs Desktop Order Share

Insight: 3 out of 4 orders were placed on mobile.

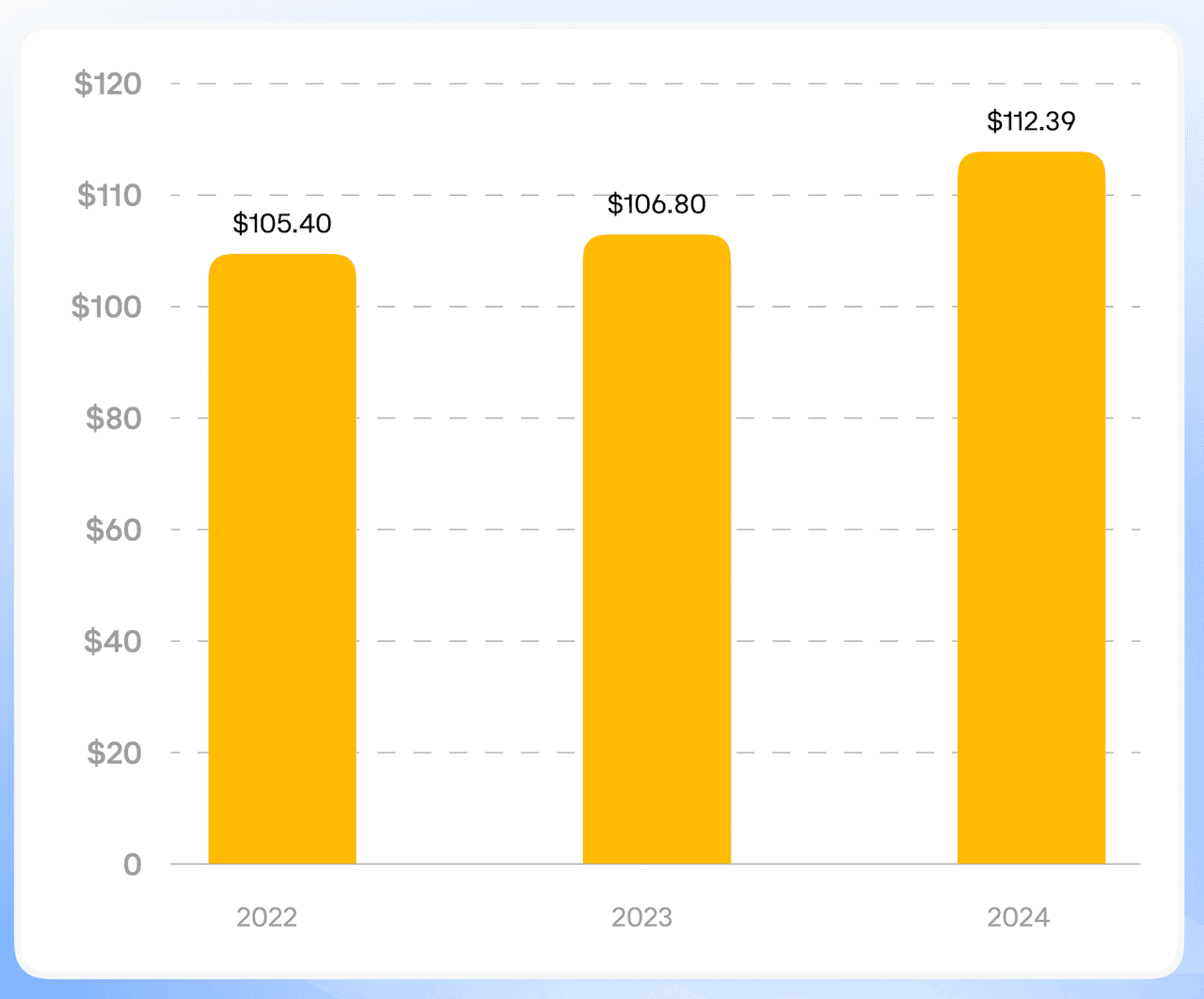

Average Order Value Trend (2022–2024)

Insight: AOV climbed +5.2% YoY, driven by bundles and post-purchase upsells.

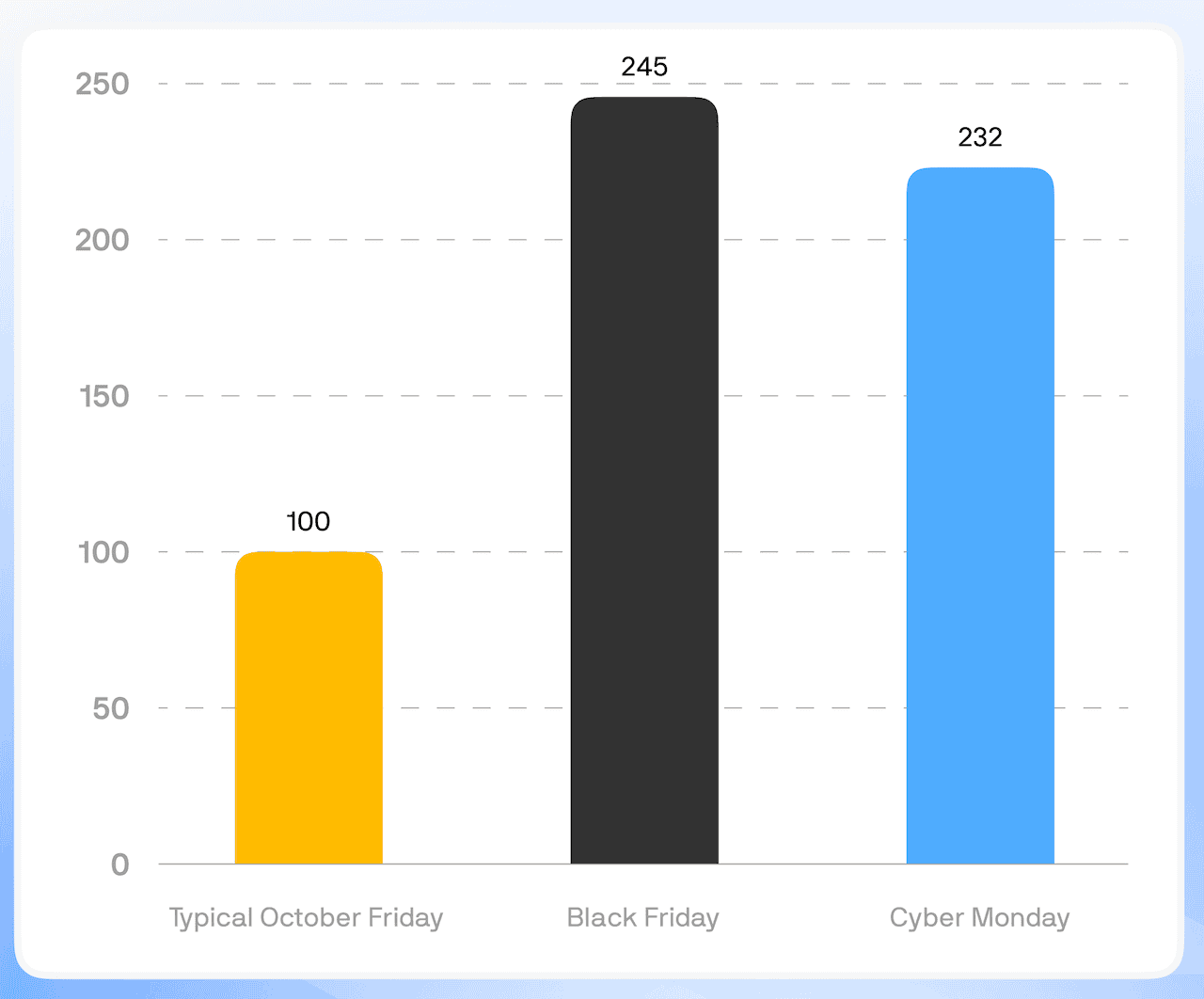

Revenue Lift vs October Baseline

Insight: BFCM delivered a +145% lift over baseline Fridays.

Data Story

Here’s what really stood out, and what too many brands missed, in BFCM 2024.

1. U.S. Holiday E-Commerce Hit Record Highs

- From Nov 1 to Dec 31, 2024, online holiday sales in the U.S. topped $241.4 billion, up 8.7% YoY.

- During the Cyber Week window (Thanksgiving → Cyber Monday), consumers spent $41.1 billion, representing an 8.2% YoY increase.

- On Cyber Monday alone, U.S. shoppers spent $13.3 billion, up 7.3% year over year, making it the single biggest online sales day ever

- Mobile & Payment Signals Shifted Behavior

- On Cyber Monday, 57% of purchases were via mobile devices, $7.6 billion in spend.

- BNPL (Buy Now, Pay Later) set a new record: nearly $991.2 million in BNPL spend on Cyber Monday, up from the prior year.

- Black Friday online sales in the U.S. hit $10.8 billion, growing 10.2% YoY.

- Peak Cyber Monday hours (8pm-10pm ET) saw $15.8 million spent every minute.

3. Discount Depth & Channel Influence

-

On Cyber Monday, prices in key categories slashed deeply:

• Electronics: ~30.1% off listed price

• Apparel: ~23.2% off

• Televisions: ~21.8% off

• Computers: ~21.5% off

-

Influencers and affiliate channels drove ~20% of Cyber Monday revenue, a growing share of conversion influence.

- Earlier BFCM campaign starts drive dramatically higher gross profit gains

- Brands that started campaigns very early (before October 15) saw a 721% increase in BFCM gross profit versus their September baseline

- Early starters (October 15-31) achieved a 470% increase

- Late starters (November 1-15) saw a 347% increase

- Last-minute campaigns (after November 15) only generated a 318% increase

5. Dramatic efficiency advantage of Retention over Prospecting during BFCM:

- Retention channels (brand search, remarketing, retargeting, PMAX retention) delivered a 5.04 incremental ROAS during BFCM 2024

- Prospecting channels (non-brand search, PMAX prospecting, awareness campaigns) only achieved a 1.83 incremental ROAS during the same period

Key Takeaways & What You Should Watch

-

Start BFCM early.

Starting your BFCM campaigns before mid-October can deliver more than 2x the gross profit lift compared to waiting until mid-November. The data shows a clear correlation between early audience priming and ultimate BFCM performance.

-

Mobile is table stakes.

Over half of spending now comes through phones. If your mobile experience, or your one-click flows are fragile, you lose at peak.

-

Set up Buy Now, Pay Later (BNPL) and flexible payments.

$991M in BNPL on a single day signals that offering flexibility isn’t optional, it’s expected

-

Deep discounts still ruled, but saturation limits returns.

You’ll see diminishing returns on further discounting if you don’t offset with experience, exclusivity, or scarcity.

-

Affiliate/influencer channels are non-linear multipliers.

At ~20% of revenue, they’re no longer “bonus” channels, they’re core acquisition and conversion amplifiers.

-

Build an audience early and heavily lean into retention tactics.

Set up tracking correctly. Remember your audience. Remarketing to existing audiences, brand search during the actual promotional period, while using prospecting more in the lead-up weeks to build that audience pool.

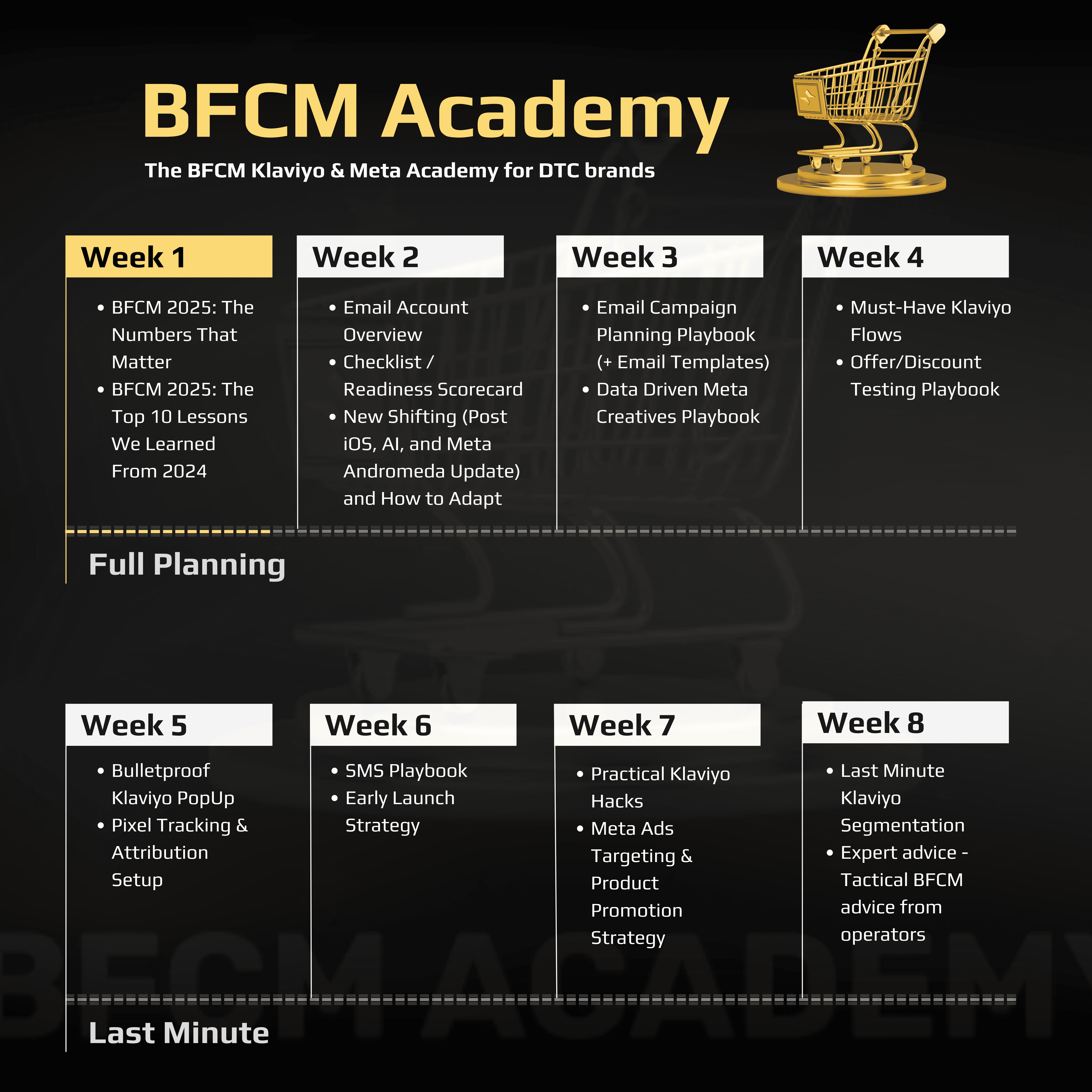

🎉 The Kickoff: Welcome to the BFCM Klaviyo & Meta Academy for DTC Brands

This isn’t just another training series.

This is 8 weeks of deep data, engineering insights, and tactical frameworks built for the DTC operators who want to out-measure, out-adapt, and out-execute everyone else this BFCM.

We’re lifting the hood on what 1,000+ Shopify installs taught us, and turning it into actionable playbooks across tracking, flows, segmentation, Meta creative systems, and retention automation.

Every session builds on the lasts, so by the end of this, your entire growth stack will be rebuilt for precision.

The 8-Week Academy Roadmap

Why Join

Every week, you’ll see how the best operators are rebuilding their Klaviyo and Meta infrastructure for real signal accuracy, sustainable ROAS, and retention-driven growth.

No theory. No fluff. Just frameworks that work, proven inside 1,000+ DTC stacks.

👉 Sign up for the newsletter: https://newsletter.aimerce.ai/